When buying property in Spain, one of the first formal steps is signing a reservation contract, commonly known as an arras contract. This agreement protects both buyer and seller while the purchase process moves forward.

What is an arras contract?

An arras contract is a private agreement between buyer and seller that:

-

Reserves the property at an agreed price.

-

Sets a timeframe (usually 1–3 months) to complete at the notary.

-

Includes a deposit, normally 10% of the purchase price.

Types of arras

The most common type in Spain is arras penitenciales (penitential deposit), regulated by Article 1454 of the Civil Code. This allows either party to withdraw, but with consequences:

-

If the buyer withdraws: they lose the deposit.

-

If the seller withdraws: they must return double the deposit to the buyer.

Other forms (arras confirmatorias or arras penales) exist but are less used in property sales.

What happens after signing?

-

The buyer usually pays the deposit by bank transfer.

-

The property is taken off the market.

-

The lawyer begins due diligence: checking ownership, debts, planning issues, and certificates.

-

Completion is arranged at the notary within the agreed deadline.

Example

John agrees to buy a villa in Catral for €200,000.

-

He pays €20,000 deposit (10%) when signing the arras.

-

If he later changes his mind, he loses the €20,000.

-

If the seller backs out, they must refund him €40,000.

-

Both are now committed to proceed, unless prepared to accept the penalties.

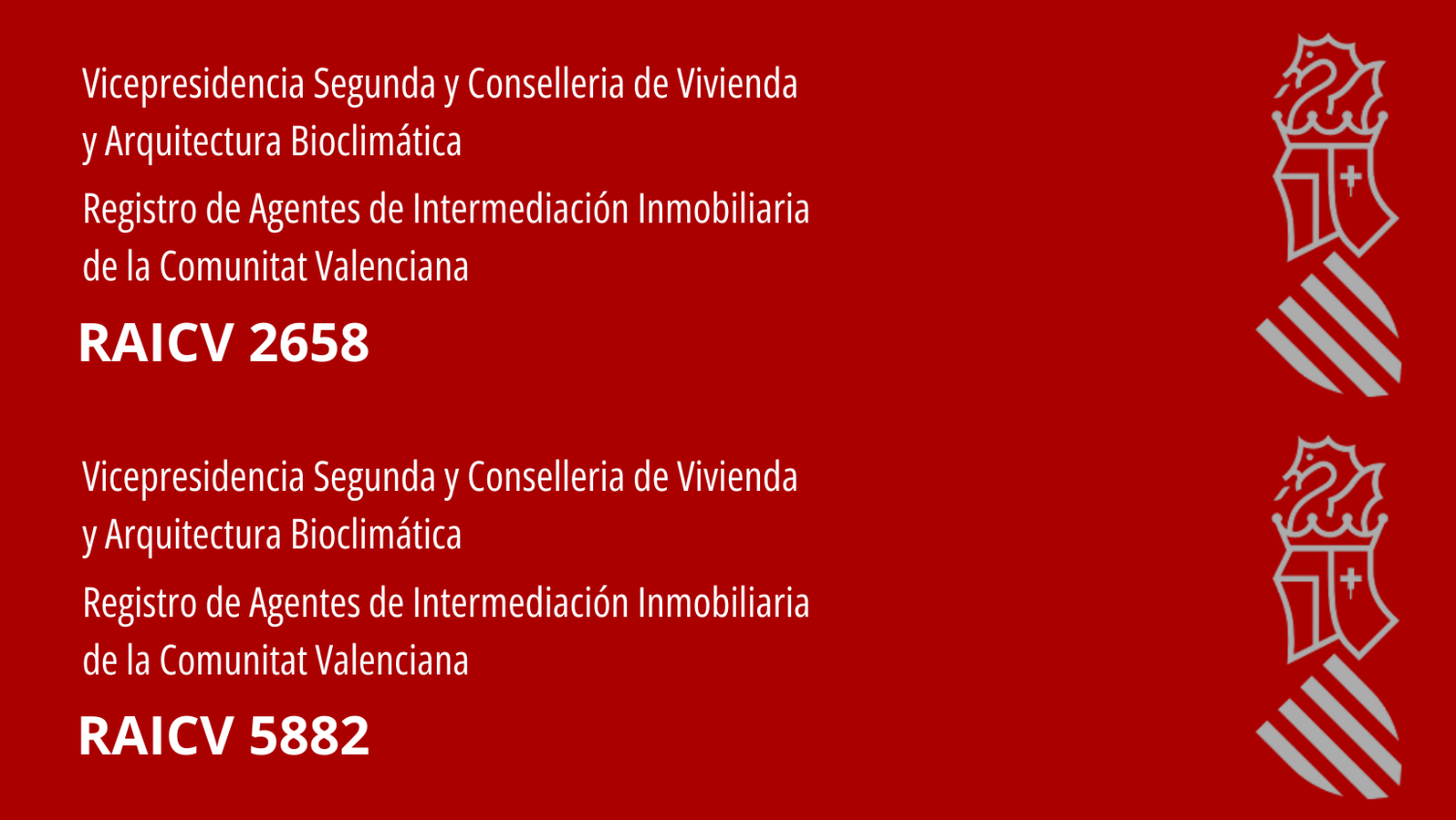

At Holiday Homes Catral, we prepare arras contracts that are clear, fair, and fully bilingual. We check that all conditions are transparent, that deposits are handled securely, and that buyers and sellers know exactly what they are signing.

⚖️ Disclaimer: This article refers to arras penitenciales, the most common type used in Alicante property transactions. Legal conditions may vary depending on the case. Always seek professional legal advice before signing.